Do Kwon launched a movement around his cryptocurrency: Terra Luna. His disciples called themselves “Lunatics.” An identity that millions of people wrapped their savings (and their sense of self) around.

At its peak, Terra Luna’s market cap was $40 billion.

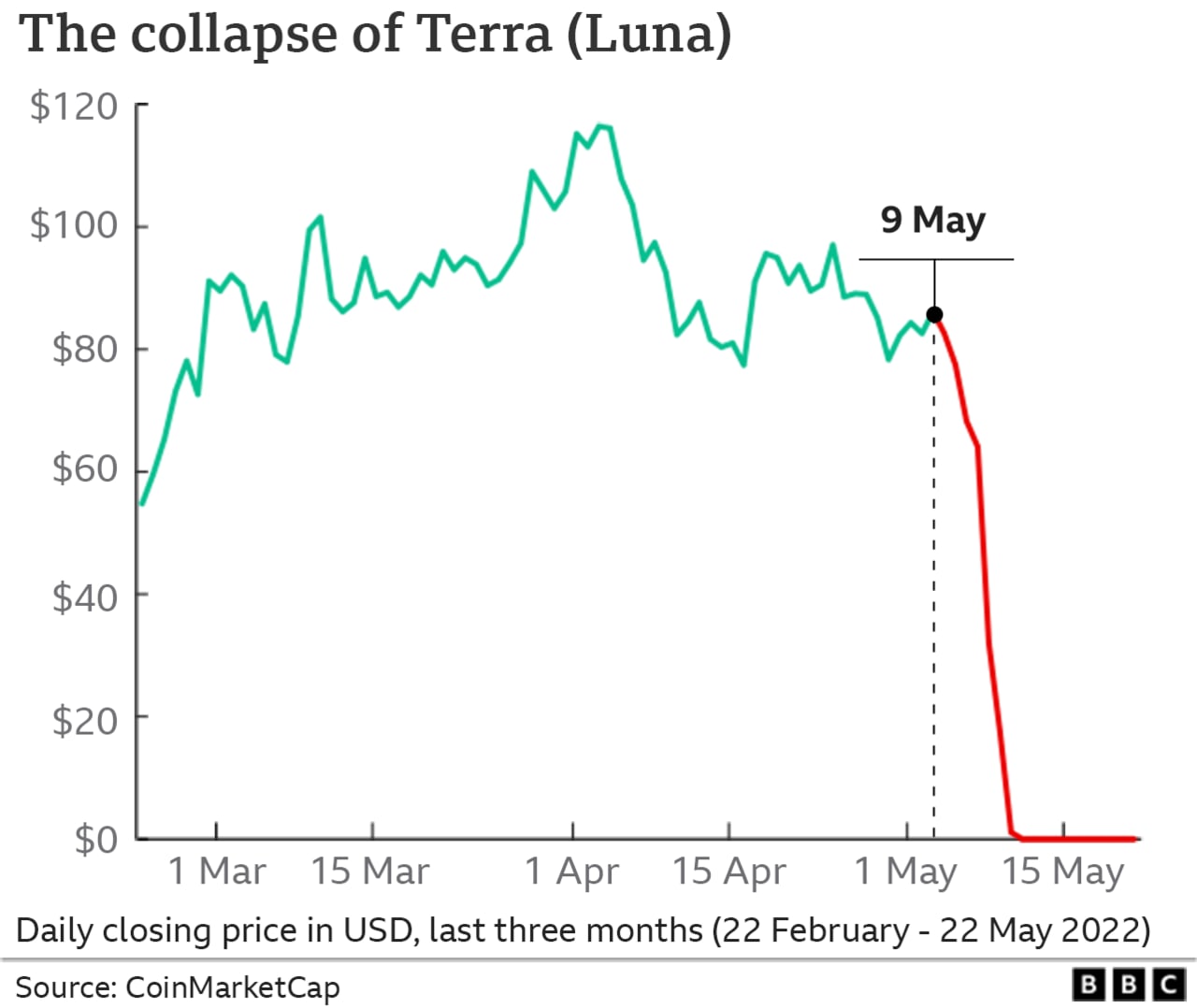

Then, in May 2022, it collapsed to $0.

I break down the full story here

The story is a cautionary tale about crypto, or fraud, or hubris. But there’s a more uncomfortable truth buried underneath: Do Kwon ran a similar playbook to Steve Jobs.

Building a religion around your product isn’t new. Jobs did it. Elon does it. When it works, you get customers who tattoo your logo on their body and defend you in public for free.

The playbook is remarkably consistent:

Create an enemy. Jobs had IBM. Elon has legacy automakers. Do Kwon had the entire traditional finance system.

Build identity, not just utility. Nobody buys Apple or Tesla products because it’s the most cost-effective option. They buy it because of what it says about them. Terra Luna worked the same way. Everyday investors were joining a movement.

Make believers feel like insiders. Early Apple adopters felt like rebels against corporate conformity. Tesla owners felt like co-conspirators on a mission to save the planet. UST and Luna holders felt like they were playing a role in the future of money. That feeling of secret knowledge is intoxicating. It also blinds people to red flags.

Do Kwon executed this playbook almost perfectly. But the problem wasn’t the tactics: it was what they were built on top of.

Here’s where Terra Luna diverges from Apple.

When the iPhone launched, it delivered.

Do Kwon built his religion on a story that couldn’t survive contact with reality. His “algorithmic stablecoin” promised the holy grail of crypto: a fully decentralized stable currency you could actually use.

Turns out, the entire project was built on fraud. Faked transaction data. Secret payoffs to prop up the price. Stolen Bitcoin reserves.

So when investors started panic-selling, there was nothing to stop the collapse.

The founder lesson isn’t “don’t build a movement.” Movements work. They create moats and compounding advantages.

The lesson is simpler, and darker: movements amplify whatever’s underneath them.

If your product delivers real value, a religious following will defend you through rough patches and evangelize you into new markets. Apple fans forgave the hockey puck mouse. Tesla owners moved past panel gaps. Airbnb hosts fought regulations city by city.

But if your product doesn’t deliver the value promised, the community you built will turn on you.

Build movements. Just make sure the thing underneath them is real.

Hiten

=)

Transcript

This is Nationals Park. Inside is the Terra Club. It’s a private lounge full of politicians and bankers. In the corner, a Korean man is sitting in a black hoodie. This man has just signed a $40 million deal to sponsor the home team. His nickname: the King of the Lunatics.

Two blocks away, a college student is booking flights home. He scrolls past Apple and Google Pay at checkout. Instead, the kid taps UST and pays with crypto.

5,000 miles away in Montenegro, Interpol agents are putting together a case. The target has been on the run for nearly a year, but the hunt is almost over. They know that tomorrow he’s on a flight to Dubai.

This is the rise and fall of Do Kwon, the man who built a $40 billion religion around a cryptocurrency that collapsed in a week.

In January 2025, he was on trial for his role in the crash and pleaded not guilty. But in August he did a U-turn and pleaded guilty to two fraud charges.

How did he convince millions to believe in his product, and what were the lies that brought it all down?

Before we go any further, you need to understand what Do Kwon promised everyday investors.

This is Chad. He’s in corporate making a decent salary. He’s just been denied a mortgage. Chad’s been looking into crypto as a way to earn more, but he’s skeptical. The news is full of meme coins. An image of a clock just sold for $52 million.

But one night scrolling Twitter, Chad sees something less crazy. It’s a thread from Do Kwon: “Banks lend your money to make profits. This is the system keeping you poor. Terra changes that.”

The thread explains how it works. Two tokens: UST, a stablecoin, and Luna, a volatile one. The price of Luna adjusts to keep UST stable. No banks, no government.

Chad skips ahead. All he wants to know is: can you actually use this? He goes on Reddit to find the answer. Turns out you can use UST to buy food, Apple shares, and even book flights. He sees that the private lounge inside Nationals Stadium was renamed the Terra Club.

Chad knows he should be nervous. This is his entire savings. But he pulls the trigger and transfers $100,000 into UST. His worries don’t last long. By the end of the month, he’s up 20%. A few more months and he can finally afford that house.

But here’s the thing — Chad wasn’t alone. From 2021 to 2022, the amount invested in UST grew to $18 billion. Millions had bought into Do Kwon’s promise: a stable cryptocurrency you could actually use, free from banks and government control.

So now you understand what made Terra so appealing. But a vision alone doesn’t get millions of people to go all in. What you’re about to see are the tactics Do Kwon used to turn Terra into a must-have for people like Chad. These are the same tactics Steve Jobs used at Apple, Elon Musk at Tesla, and Brian Chesky at Airbnb. The difference? Their products actually worked.

This is how Do Kwon built a religion around his product. His playbook was made up of four tactics.

First, he sold a story. Banks and governments were the enemy, and the hero could be anyone. If you bought UST. Do Kwon proved it. People were using UST to buy groceries in Korea on an app called Chai. In America, they were using it to trade stocks 24/7. This narrative helped Terra raise $200 million in venture capital.

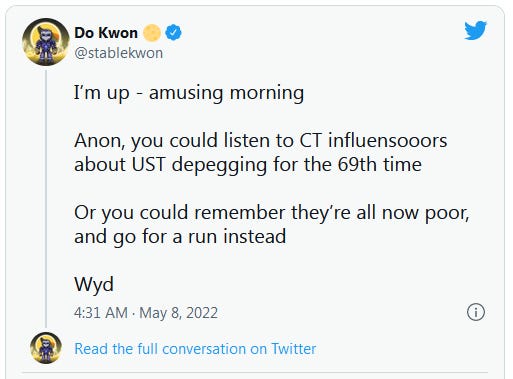

Next, Do Kwon gave his followers an identity: Lunatics. And he showed them how to act — naming his daughter Luna, mocking critics in public with lines like “Enjoy being poor,” and even betting one critic $11 million that Terra would keep growing. Believers felt superior. Skeptics looked small. Eventually, the Lunatics did all of this for him.

The next step was to reward his followers. In March 2021, he offered 20% returns to anyone who held UST, 40 times what you could earn in a savings account. People asked, “How is this possible?” His answer: “It’s like dividends. As long as Terra grows, everyone wins.”

Once people had a stake, they became evangelists. And soon they were needed. In May 2021, Terra faced its first real test: UST became volatile. Critics said it would collapse, but the system stabilized. Do Kwon called it a triumph of decentralization. Lunatics spread the story everywhere. To them, it proved the system worked and their 20% was safe.

Finally, Do Kwon built social proof. In April 2022, he raised money and bought $3.5 billion of Bitcoin. The message: UST is backed by mainstream crypto. But the most powerful validation came from Wall Street and the MLB. Mike Novogratz tweeted a viral photo of his Terra tattoo. The Nationals announced a $40 million sponsorship. Every high-profile endorsement made doubters think, “What am I missing?”

By May 1st, 2022, the four tactics had worked. Millions of people held UST and Luna. Not because they fully understood how it worked, but because Do Kwon had created a sense of FOMO and social pressure. If you spoke out, you either looked dumb or against the future of money.

But here’s what Jobs, Musk, and Chesky understood that Do Kwon didn’t: You can create a connection, build empathy, and scale a narrative quickly. But eventually the fundamentals catch up.

So the product better work. But Terra’s didn’t. In less than one week, it all came crashing down.

It’s 6:00 PM in a small, crowded airport terminal. Do Kwon hears his boarding call to Dubai. He closes his laptop and walks toward the gate. Behind him, two plainclothes officers get up and follow.

Right as Do Kwon reaches for his boarding pass, the Interpol agents detain him. Do Kwon is on the floor in handcuffs. His fake passport skids across the tiles.

The question is: why is he being arrested?

On the 9th of May, 2022, both UST and Luna collapsed. Investors panicked and there was a massive sell-off. Terra’s market cap fell from $40 billion to zero.

As investigators dug in, they found something far worse than a failed cryptocurrency: a web of lies. And one by one, the SEC and DOJ exposed them.

Lie #1: Some of the use cases weren’t real. Remember the Korean payment app called Chai? The data was faked by Do Kwon. And the 24/7 stock market? Bots made it look like people were trading.

Lie #2: Demand wasn’t organic. Remember those returns Do Kwon compared to dividends? Investigators found Terra was paying for those 20% returns with runway, not revenue. It was subsidized growth just to get more people holding UST.

Lie #3: Do Kwon potentially stole from the Bitcoin reserve. After the crash, most of it disappeared. Investigators still can’t trace where it ended up.

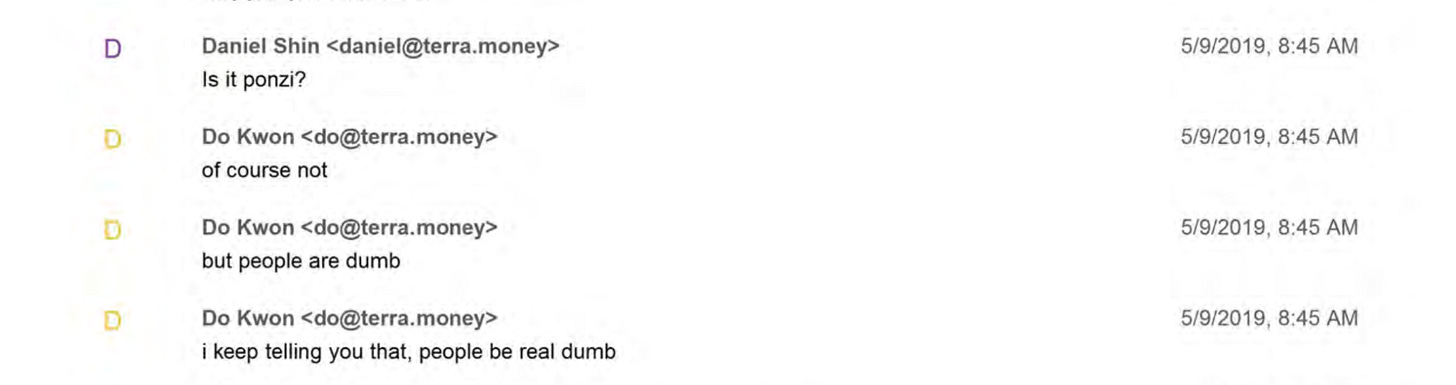

Lie #4: He knew the two-token system would fail. It turns out Do Kwon had tried this exact stablecoin design before under the alias “Rick Sanchez.” But that project collapsed in under two months. Yet he still built and scaled Terra anyway.

Lie #5: When UST went volatile in 2021, the system didn’t fix itself like Do Kwon said. Instead, he made it look like it did — secretly paying a trading firm $100 million to buy UST. It wasn’t self-stabilizing and it wasn’t decentralized.

So when investigators pieced it all together, Do Kwon’s story fell apart. The Lunatics quickly turned their backs. Terra subreddits went from worshiping Do Kwon to hating him.

That’s why in August 2025, Do Kwon changed his mind. He pled guilty to fraud and conspiracy, admitting to misleading investors while leading Terraform Labs.

On December 11th, he was sentenced to 15 years in prison.

And Chad, who was up 20%, already planning for that house, never got his money back.